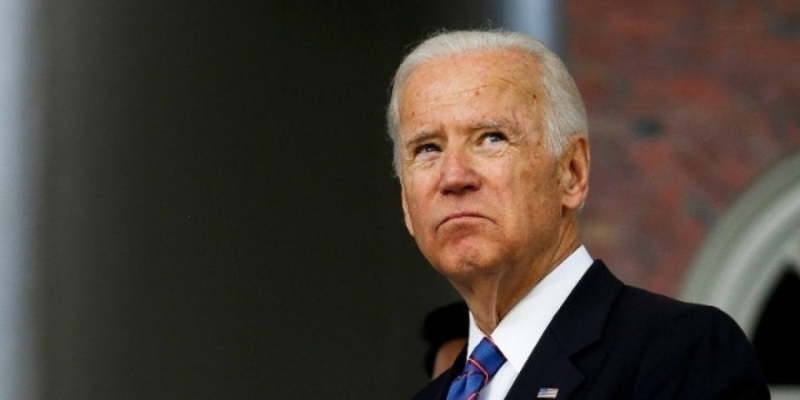

Americans can "trust" in a "solid" banking system and the president will do "whatever is necessary" to stay that way: Joe Biden today sought to calm concerns about the collapse of Silicon Valley Bank.

"We will not stop there" and "we will do everything necessary", he assured after the US authorities placed the Californian bank under supervision and intervened quickly in the face of the bankruptcy of two smaller banks.

The US president, during a brief speech in The White House announced that it will ask Congress to legislate for the "enhancement" of banking regulation, which was tightened after the collapse of Lehman Brothers in 2008 but then eased by his predecessor, Donald Trump.

The 80-year-old Democratic president, who is already quietly campaigning for the 2024 election, also assured that American taxpayers will not be asked to deal with the turmoil of the moment.

If bank deposits are guaranteed , Joe Biden stressed that investors and shareholders will not be "protected" from the damages they suffered.

The US president must fuel the most valuable resource in the markets: confidence, the only bulwark against a large-scale contagion from Silicon Valley Bank's (SVB) problems.

Authorities have taken steps in USA and Europe to protect the deposits of a Californian bank, which went bankrupt and was placed under state supervision yesterday Sunday.

Guaranteed withdrawals

European shares fell sharply today, heading for their worst day in almost three months, as European banking stocks continued to slide despite measures taken by authorities to limit the impact of the sudden collapse of SVB. European bank shares fell 5.7% and are heading for their worst two-day selloff since the Russia-Ukraine war broke out last year.

Wall Street's three main indexes posted losses at the open New York Stock Exchange. The Dow Jones was down 0.28%, the S&P 500 was down 0.69% and the Nasdaq was down 0.87%.

Oil prices also fell as investors focused on the risks posed to the financial system by the collapse of SVB.

The American authorities announced yesterday, Sunday, for their part, a series of measures to reassure individuals and businesses about the stability of the American banking system. Mainly they will guarantee all deposits in the bankrupt SVB bank. In addition to SVB, they will allow access to all the deposits of another institution, Signature Bank, which was shut down by the regulator, much to everyone's surprise.

In addition, the Fed, the US Federal Reserve Bank, has undertaken to lend the necessary funds to other banks that may need them to meet withdrawal requests from their customers.

London, for its part, announced that SVB's UK subsidiary had been sold to British banking giant HSBC UK Bank, British subsidiary of the banking giant, for £1.

"SVB UK customers will be able to access their deposits and banking services as normal from today," the British Treasury clarified in a statement.

Avoid transmission >

The authorities want at all costs to avoid a panic in the markets today and mass withdrawals by bank customers, a "bank run" with potentially disastrous consequences.

SVB's collapse illustrates the disruption of the entire US banking system in the face of the Fed's tightening of monetary policy.

Rising interest rates in the US have encouraged customers to put their money into higher-paying financial products from current accounts, weakening a critical source for the cash-hungry new technology sector.

This wave of bank foreclosures brought three banks to their knees last week: SVB, Signature Bank and Silvergate Bank, smaller but known for its privileged ties to the cryptocurrency community.

At the same time, US authorities put SVB up for auction with the aim of finding a buyer as soon as possible.

The race against time this weekend is reminiscent of September 13 and 14, 2008. US authorities at the time had failed to find a buyer for Lehman Brothers and refused to intervene, prompting the bank to file for bankruptcy, with dramatic consequences for the industry and the global economy as a whole.

European Finance Commissioner Paolo Gentiloni assessed today that the bankruptcy of SVB and Signature Bank does not constitute a "significant risk" for the European financial system. "There is no direct contagion and the possibility of an indirect impact is something we have to monitor, but at the moment we do not see a significant risk," he said from Brussels, ahead of a meeting of eurozone finance ministers.

In Germany's banking watchdog Bafin today assured that SVB's bankruptcy does not pose a "threat to financial stability" of the country. French Economy Minister Bruno Le Maire also said he did not "see any risk of contagion" for the country's financial institutions.

Read also: The bankruptcy of Silicon Valley Bank does not endanger French banks

Source: APE-MPE