POWERED BY:

18:22 Sunday

22 May 2022 INSIDER • GOAL • IN-CYPRUS • PROPERTY • CYPRUS-IS • CAREER LIKE • GOING OUT • XRYSES SYNTAGES • ACTIVE • PHILGROUP NEWS & nbsp; SOCIETY & nbsp; INSIDER & nbsp; OPINIONS & nbsp; GOING OUT & nbsp; CULTURE & nbsp; SPORTS & nbsp; AUTO & nbsp; GOOD LIFE & nbsp; USEFUL & nbsp; PRINTED EDITION & nbsp;

ΑΡΧΙΚΗΕΙΔΗΣΕΙΣΠΟΛΙΤΙΚΗΤΟΠΙΚΑΠΑΡΑΣΚΗΝΙΟMEDIAΕΛΛΑΔΑΚΟΣΜΟΣΕΠΙΣΤΗΜΗΠΕΡΙΒΑΛΛΟΝΤΕΧΝΟΛΟΓΙΑΣΥΝΕΝΤΕΥΞΕΙΣΧΡΥΣΕΣ ΕΤΑΙΡΕΙΕΣΚΟΙΝΩΝΙΑΕΙΔΗΣΕΙΣΚΥΠΡΟΣ ΤΟΥ ΧΘΕΣΑΝΑΓΝΩΣΤΗ ΕΧΕΙΣ ΛΟΓΟΕΠΙΣΤΟΛΕΣΣΥΝΕΝΤΕΥΞΕΙΣΔΗΜΟΦΙΛΗ ΣΤΟ INTERNETVIDEOSΑΦΙΕΡΩΜΑΤΑADVERTORIALINSIDERΕΠΙΧΕΙΡΗΣΕΙΣΚΥΠΡΟΣBRAND VOICECAPITALFORBESBLOOMBERG OPINIONΠΡΩΤΑΓΩΝΙΣΤΕΣΚΑΥΤΗ ΓΡΑΜΜΗΧΡΥΣΕΣ ΕΤΑΙΡΕΙΕΣΚΑΡΙΕΡΑΑΠΟΨΕΙΣΑΡΘΡΑ ΣΤΟΝ “Φ”ΠΑΡΕΜΒΑΣΕΙΣ ΣΤΟΝ “Φ”ΤΟ ΜΗΝΥΜΑ ΣΟΥ ΣΚΙΤΣΑΟ ΚΟΣΜΟΣ ΤΟΥ TWITTERGOING OUTTHINGS TO DOCINEMAΜΟΥΣΙΚΗΕΣΤΙΑΤΟΡΙΑBAR/CAFETV ΟΔΗΓΟΣΤΗΛΕΟΡΑΣΗΠΟΛΙΤΙΣΜΟΣΚΥΠΡΟΣΚΟΣΜΟΣΚΡΙΤΙΚΕΣΕΚΔΗΛΩΣΕΙΣΠΡΟΣΩΠΑΑΘΛΗΤΙΚΑΠΟΔΟΣΦΑΙΡΟΜΠΑΣΚΕΤΠΑΡΑΣΚΗΝΙΑΕΛΛΑΔΑΔΙΕΘΝΗΑΛΛΑ ΣΠΟΡΑΠΟΨΕΙΣΣΚΙΤΣΟVIDEOSAUTOΝΕΑΠΑΡΟΥΣΙΑΣΗΑΠΟΣΤΟΛΕΣΑΓΩΝΕΣΚΑΛΗ ΖΩΗΥΓΕΙΑΔΙΑΤΡΟΦΗΕΥ ΖΗΝΑΣΤΡΑΧΡΥΣΕΣ ΣΥΝΤΑΓΕΣΣΥΝΤΑΓΕΣ ΣΕΦΒΗΜΑ ΒΗΜΑΧΡΗΣΙΜΑΦΑΡΜΑΚΕΙΑΓΙΑΤΡΟΙΑΕΡΟΔΡΟΜΙΑΛΙΜΑΝΙΑΤΗΛΕΦΩΝΑΟΠΑΠΚΑΙΡΟΣΣΥΝΑΛΛΑΓΜΑΛΑΧΕΙΑAPPSΠΡΟΣΦΟΡΕΣΕΝΤΥΠΗ ΕΚΔΟΣΗ ΠΟΛΙΤΙΚΗΤΟΠΙΚΑΠΑΡΑΣΚΗΝΙΟMEDIAΕΛΛΑΔΑΚΟΣΜΟΣΕΠΙΣΤΗΜΗΠΕΡΙΒΑΛΛΟΝΤΕΧΝΟΛΟΓΙΑΣΥΝΕΝΤΕΥΞΕΙΣΧΡΥΣΕΣ ΕΤΑΙΡΕΙΕΣ ΕΙΔΗΣΕΙΣΚΥΠΡΟΣ ΤΟΥ ΧΘΕΣΑΝΑΓΝΩΣΤΗ ΕΧΕΙΣ ΛΟΓΟΕΠΙΣΤΟΛΕΣΣΥΝΕΝΤΕΥΞΕΙΣΔΗΜΟΦΙΛΗ ΣΤΟ INTERN ETVIDEOSΑΦΙΕΡΩΜΑΤΑADVERTORIAL ΕΠΙΧΕΙΡΗΣΕΙΣΚΥΠΡΟΣBRAND VOICECAPITALFORBESBLOOMBERG OPINIONΠΡΩΤΑΓΩΝΙΣΤΕΣΚΑΥΤΗ ΓΡΑΜΜΗΧΡΥΣΕΣ ΕΤΑΙΡΕΙΕΣΚΑΡΙΕΡΑ ΑΡΘΡΑ ΣΤΟΝ “Φ”ΠΑΡΕΜΒΑΣΕΙΣ ΣΤΟΝ “Φ”ΤΟ ΜΗΝΥΜΑ ΣΟΥ ΣΚΙΤΣΑΟ ΚΟΣΜΟΣ ΤΟΥ TWITTER THINGS TO DOCINEMAΜΟΥΣΙΚΗΕΣΤΙΑΤΟΡΙΑBAR/CAFETV ΟΔΗΓΟΣΤΗΛΕΟΡΑΣΗ ΚΥΠΡΟΣΚΟΣΜΟΣΚΡΙΤΙΚΕΣΕΚΔΗΛΩΣΕΙΣΠΡΟΣΩΠΑ ΠΟΔΟΣΦΑΙΡΟΜΠΑΣΚΕΤΠΑΡΑΣΚΗΝΙΑΕΛΛΑΔΑΔΙΕΘΝΗΑΛΛΑ ΣΠΟΡΑΠΟΨΕΙΣΣΚΙΤΣΟVIDEOS ΝΕΑΠΑΡΟΥΣΙΑΣΗΑΠΟΣΤΟΛΕΣΑΓΩΝΕΣ ΥΓΕΙΑΔΙΑΤΡΟΦΗΕΥ ΖΗΝΑΣΤΡΑΧΡΥΣΕΣ ΣΥΝΤΑΓΕΣΣΥΝΤΑΓΕΣ ΣΕΦΒΗΜΑ ΒΗΜΑ ΦΑΡΜΑΚΕΙΑΓΙΑΤΡΟΙΑΕΡΟΔΡΟΜΙΑΛΙΜΑΝΙΑΤΗΛΕΦΩΝΑΟΠΑΠΚΑΙΡΟΣΣΥΝΑΛΛΑΓΜΑΛΑΧΕΙΑAPPSΠΡΟΣΦΟΡΕΣ ΕΠΙΧΕΙΡΗΣΕΙΣ ΚΥΠΡΟΣ BRAND VOICE CAPITAL FORBES BLOOMBERG OPINION ΠΡΩΤΑΓΩΝΙΣΤΕΣ ΚΑΥΤΗ ΓΡΑΜΜΗ GOLDEN CAREER COMPANIES

ΑΡΧΙΚΗΕΙΔΗΣΕΙΣΠΟΛΙΤΙΚΗΤΟΠΙΚΑΠΑΡΑΣΚΗΝΙΟMEDIAΕΛΛΑΔΑΚΟΣΜΟΣΕΠΙΣΤΗΜΗΠΕΡΙΒΑΛΛΟΝΤΕΧΝΟΛΟΓΙΑΣΥΝΕΝΤΕΥΞΕΙΣΧΡΥΣΕΣ ΕΤΑΙΡΕΙΕΣΚΟΙΝΩΝΙΑΕΙΔΗΣΕΙΣΚΥΠΡΟΣ ΤΟΥ ΧΘΕΣΑΝΑΓΝΩΣΤΗ ΕΧΕΙΣ ΛΟΓΟΕΠΙΣΤΟΛΕΣΣΥΝΕΝΤΕΥΞΕΙΣΔΗΜΟΦΙΛΗ ΣΤΟ INTERNETVIDEOSΑΦΙΕΡΩΜΑΤΑADVERTORIALINSIDERΕΠΙΧΕΙΡΗΣΕΙΣΚΥΠΡΟΣBRAND VOICECAPITALFORBESBLOOMBERG OPINIONΠΡΩΤΑΓΩΝΙΣΤΕΣΚΑΥΤΗ ΓΡΑΜΜΗΧΡΥΣΕΣ ΕΤΑΙΡΕΙΕΣΚΑΡΙΕΡΑΑΠΟΨΕΙΣΑΡΘΡΑ ΣΤΟΝ “Φ”ΠΑΡΕΜΒΑΣΕΙΣ ΣΤΟΝ “Φ”ΤΟ ΜΗΝΥΜΑ ΣΟΥ ΣΚΙΤΣΑΟ ΚΟΣΜΟΣ ΤΟΥ TWITTERGOING OUTTHINGS TO DOCINEMAΜΟΥΣΙΚΗΕΣΤΙΑΤΟΡΙΑBAR/CAFETV ΟΔΗΓΟΣΤΗΛΕΟΡΑΣΗΠΟΛΙΤΙΣΜΟΣΚΥΠΡΟΣΚΟΣΜΟΣΚΡΙΤΙΚΕΣΕΚΔΗΛΩΣΕΙΣΠΡΟΣΩΠΑΑΘΛΗΤΙΚΑΠΟΔΟΣΦΑΙΡΟΜΠΑΣΚΕΤΠΑΡΑΣΚΗΝΙΑΕΛΛΑΔΑΔΙΕΘΝΗΑΛΛΑ ΣΠΟΡΑΠΟΨΕΙΣΣΚΙΤΣΟVIDEOSAUTOΝΕΑΠΑΡΟΥΣΙΑΣΗΑΠΟΣΤΟΛΕΣΑΓΩΝΕΣΚΑΛΗ ΖΩΗΥΓΕΙΑΔΙΑΤΡΟΦΗΕΥ ΖΗΝΑΣΤΡΑΧΡΥΣΕΣ ΣΥΝΤΑΓΕΣΣΥΝΤΑΓΕΣ ΣΕΦΒΗΜΑ ΒΗΜΑΧΡΗΣΙΜΑΦΑΡΜΑΚΕΙΑΓΙΑΤΡΟΙΑΕΡΟΔΡΟΜΙΑΛΙΜΑΝΙΑΤΗΛΕΦΩΝΑΟΠΑΠΚΑΙΡΟΣΣΥΝΑΛΛΑΓΜΑΛΑΧΕΙΑAPPSΠΡΟΣΦΟΡΕΣΕΝΤΥΠΗ ΕΚΔΟΣΗ ΠΟΛΙΤΙΚΗΤΟΠΙΚΑΠΑΡΑΣΚΗΝΙΟMEDIAΕΛΛΑΔΑΚΟΣΜΟΣΕΠΙΣΤΗΜΗΠΕΡΙΒΑΛΛΟΝΤΕΧΝΟΛΟΓΙΑΣΥΝΕΝΤΕΥΞΕΙΣΧΡΥΣΕΣ ΕΤΑΙΡΕΙΕΣ ΕΙΔΗΣΕΙΣΚΥΠΡΟΣ ΤΟΥ ΧΘΕΣΑΝΑΓΝΩΣΤΗ ΕΧΕΙΣ ΛΟΓΟΕΠΙΣΤΟΛΕΣΣΥΝΕΝΤΕΥΞΕΙΣΔΗΜΟΦΙΛΗ ΣΤΟ INTERN ETVIDEOSΑΦΙΕΡΩΜΑΤΑADVERTORIAL ΕΠΙΧΕΙΡΗΣΕΙΣΚΥΠΡΟΣBRAND VOICECAPITALFORBESBLOOMBERG OPINIONΠΡΩΤΑΓΩΝΙΣΤΕΣΚΑΥΤΗ ΓΡΑΜΜΗΧΡΥΣΕΣ ΕΤΑΙΡΕΙΕΣΚΑΡΙΕΡΑ ΑΡΘΡΑ ΣΤΟΝ “Φ”ΠΑΡΕΜΒΑΣΕΙΣ ΣΤΟΝ “Φ”ΤΟ ΜΗΝΥΜΑ ΣΟΥ ΣΚΙΤΣΑΟ ΚΟΣΜΟΣ ΤΟΥ TWITTER THINGS TO DOCINEMAΜΟΥΣΙΚΗΕΣΤΙΑΤΟΡΙΑBAR/CAFETV ΟΔΗΓΟΣΤΗΛΕΟΡΑΣΗ ΚΥΠΡΟΣΚΟΣΜΟΣΚΡΙΤΙΚΕΣΕΚΔΗΛΩΣΕΙΣΠΡΟΣΩΠΑ ΠΟΔΟΣΦΑΙΡΟΜΠΑΣΚΕΤΠΑΡΑΣΚΗΝΙΑΕΛΛΑΔΑΔΙΕΘΝΗΑΛΛΑ ΣΠΟΡΑΠΟΨΕΙΣΣΚΙΤΣΟVIDEOS ΝΕΑΠΑΡΟΥΣΙΑΣΗΑΠΟΣΤΟΛΕΣΑΓΩΝΕΣ ΥΓΕΙΑΔΙΑΤΡΟΦΗΕΥ ΖΗΝΑΣΤΡΑΧΡΥΣΕΣ ΣΥΝΤΑΓΕΣΣΥΝΤΑΓΕΣ ΣΕΦΒΗΜΑ ΒΗΜΑ ΦΑΡΜΑΚΕΙΑΓΙΑΤΡΟΙΑΕΡΟΔΡΟΜΙΑΛΙΜΑΝΙΑΤΗΛΕΦΩΝΑΟΠΑΠΚΑΙΡΟΣΣΥΝΑΛΛΑΓΜΑΛΑΧΕΙΑAPPSΠΡΟΣΦΟΡΕΣ ΕΠΙΧΕΙΡΗΣΕΙΣ ΚΥΠΡΟΣ BRAND VOICE CAPITAL FORBES BLOOMBERG OPINION ΠΡΩΤΑΓΩΝΙΣΤΕΣ ΚΑΥΤΗ ΓΡΑΜΜΗ GOLDEN CAREER COMPANIES

EXCLUSIVE COOPERATION

EXCLUSIVE COOPERATION

TOGETHER WITH

Powered by

& nbsp & nbspΑδάμος Αδάμου & nbsp; & nbsp;

A one-time tax-free tip, as well as state monthly pensions, will now be eligible for those admitted to the public and wider public sector from October 1, 2011, when it was decided that new entrants would not be included in the existing government pension plan. reforms then taken to address fiscal challenges.

This practically meant that new entrants would receive a pension only from the Social Insurance Fund, but then there was a commitment to cover them from a provident fund, which will include part-time temporary employees in the public and wider public sector.

SEE ALSO: & nbsp; Government in the morning, shareholders in the afternoon

In this context, negotiations began for years, which were completed quite late last year, with an agreement to establish a new Professional Pension Benefit Plan. Just last Wednesday, the Council of Ministers, following a proposal by the Ministry of Finance, approved the relevant bills for the implementation of the new professional plan, which will be financed by contributions from both parties – & nbsp; employees and employer – & nbsp; amounting to 5%.

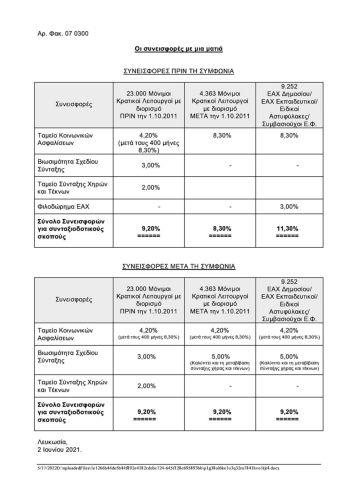

The previous day, PASYDY, which had a leading role in reaching the agreement for the new pension, with a relevant post on social media announced the submission of the bill to the Council of Ministers and a series of tables – & nbsp; which are hosted in the adjacent photos – & nbsp; explained the various changes that would occur. From the tables of PASYDY it appears that at least for the employees the cost through their contributions for financing the new Professional Pension Plan will be relatively small, only 1%, since their contribution to the TKA will be reduced, which will now end up in the new plan. For those of indefinite duration, in fact, there will be a reduction of contributions after the approval of the relevant bills by Parliament and the implementation of the agreement, since the contribution they pay today will end, in order to receive the agreed tip at the end of their careers. in the past. This was done in the context of another agreement, which is considered to be replaced with the new one since, as mentioned, the part-time part-time employees will be included in the new Professional Pension Benefits Plan that will be in force from 2011.

The various offsets that will be made and the exact way of operation of the new pension plan are expected to be developed in the context of the consideration of the new bills in the Parliament, but the arrangements have already been agreed with the trade union movement. The new Occupational Pension Plan will calculate the benefits, see pension and lump sum, on the basis of the average of all the beneficiary's salaries and not on the basis of the last salary, the pension, as was the case in the past with the current government plan. which also changed the service after 2013.

The fund and the beneficiaries

For the purposes of the operation of the new Professional Retirement Benefits Plan, the Council of Ministers approved on Wednesday the bill entitled “The Professional Retirement Benefits Plan for Civil Servants and the Public Sector (including the General Public Sector) 2022 “and which is expected to be officially submitted to Parliament.

As mentioned in the relevant proposal of the Ministry of Finance that was approved, the new Professional Pension Plan will be governed by the basic provisions of the existing Government Pension Plan concerning the service of employees from 1.1.2013 onwards. The new plan will include the following categories of employees in the public and wider public sector:

• & nbsp; All employees, at the date of entry into force of the law, permanent employees who were first appointed to a position on or after 1.10.2011, as well as those permanent employees who will be appointed for the first time to a position on or after the date of entry into force force of law, both in the Civil Service and in the Wider Public Sector. The date of accession of the above is the date of their appointment to a permanent position.

• & nbsp; All employees, at the date of entry into force of the law, employed for an indefinite period of time in the State Service and in the Wider Public Sector, the special police officers who have been appointed as special police officers under the relevant legislation, the contract non-commissioned officers and the graduates of D employed under a fixed-term employment contract. The date of accession of the aforementioned employees is 1.1.2021.

• & nbsp; All employees who, on or after the effective date of the law, will become permanent employees in the Civil Service and the Wider Public Sector. These employees will be included in the Plan on the date of conversion of their employment contract to indefinite duration.

• & nbsp; All persons who, on or after the date of entry into force of the law, will be made permanent as specialists police officers, in accordance with the relevant legislation. These persons will be included in the Plan at the date of their appointment as special police officers.

According to YPOIK, the design of the new Professional Pension Benefit Plan is based on the operating philosophy of the Provident Funds. In particular, as he explains in his proposal, a new Special Fund for the Payment of Pension Benefits will be created, which will be financed by both the employer and the employees. Specifically, the employer and each member of the Plan will pay, on both sides, an amount corresponding to a percentage equal to 5% of the monthly pensionable earnings of the member. The percentage of funding may be adjusted in the future on the basis of the results of actuarial studies that will be conducted for this purpose. The Special Fund will not be a separate legal entity and will be managed by the Minister of Finance, on behalf of the Republic.

Tax-free lump sum and inclusion of judges in the old pension plan

The second bill passed by the Council of Ministers amends the Law on Pension Benefits of Civil Servants and Employees of the Wider Public Sector, including the Local Authorities Law, so that as agreed the gratuity, the lump sum will not be subject to income tax. The amendment will also benefit the permanent employees who were appointed before 1.10.2011 as it provides for a differentiation from January 1, 2021 in the taxation of the lump sum and for the existing state pension plan. Specifically, as stated in the proposal of the Ministry of Finance, the bill abolishes the measure concerning the taxation of the lump sum with retroactive effect from 1.1.2021 for the members of the existing Government Pension Plan as well as for the members of the Plans in the Wider Public Sector that is similar to this.

Also, with the changes as reported by the Ministry of Finance, the existing Government Pensions Plan are re-included, those serving at the date of entry into force of the law, new judges, with retroactive effect from 1.10.2011 as well as new judges to be appointed in the future. >

“Therefore, both the Attorney General and the Assistant Attorney General of the Republic are reinstated in the existing Government Pension Plan, given the provisions of Article 112.4 of the Constitution, according to which these officials are members of the permanent legal service. and serve under the same conditions as the judges of the Supreme Court “, states the proposal of the Ministry of Foreign Affairs.

Regarding the reintegration of judges in the existing Government Pension Plan, the ministry also notes that according to the agreements concluded with the trade union side, the officials who will join the new plan will enjoy the same benefits, with some differences, with the members of the existing Government Pension Plan and that “therefore it was deemed appropriate for the members of the judicial service to be treated similarly, by restoring the regulations that were in force before 1.10.2011 in relation to the pension benefits that will be paid to them”./p>

“The reintegration of those affected in the existing Government Pension Plan was considered the most appropriate option since the regulations in force before 1.10.2011 in relation to the retirement benefits of judges, differ significantly in relation to the arrangements included in the bill which introduces the new Occupational Pension Benefits Plan ” , concludes YPOIK.